Many UK businesses that supply both taxable and exempt goods or services often struggle to work out exactly how much input VAT they can reclaim. In this Vat partial exemption calculation example, we show step by step how to determine the recoverable VAT.

In our previous guide, we covered the theory behind partial exemption, including the standard and special methods, the de minimis rule, and compliance requirements. Here, we take it a step further with a practical, step-by-step example showing how the rules work in real numbers.

Vat Partial Exemption Calculation Example — Quick Recap

A business is partially exempt if it:

- Is VAT-registered, and

- Supplies both taxable supplies (Standard rated or Zero-rated) and exempt supplies (VAT not charged, input VAT not recoverable).

Key points from the previous guide:

- Direct costs can be fully recoverable (for taxable supplies) or fully non-recoverable (for exempt supplies).

- Mixed costs (e.g., rent, utilities, software) need to be apportioned using the standard method, unless HMRC has approved a special method.

- The de minimis rule allows full recovery of small amounts of VAT that would otherwise be lost.

- The annual adjustment is required to reconcile provisional estimates with the actual year-end totals.

Tip: If you haven’t already, check the full WellTax guide on partial exemption for more information.

Practical Vat Partial Exemption Calculation Example

Business Scenario:

- Offers taxable consulting services

- Provides VAT-exempt training sessions

- Incurs shared overheads (rent, utilities, software)

Annual sales:

| Sales type | Amount (£) |

| Taxable services | 175,000 |

| Exempt training | 75,000 |

| Total sales | 250,000 |

Step 1 — Calculate Taxable Sales Percentage:

Taxable sales ÷ Total sales = 175,000 ÷ 250,000 = 70%

Step 2 — Classify Input VAT:

| Category | VAT (£) | Recoverable? |

| Direct taxable purchases | 9,600 | Fully |

| Direct exempt purchases | 3,200 | Not recoverable |

| Mixed overheads | 7,200 | 70% recoverable |

| Total input VAT = | 20,000 | – |

Step 3 — Apply Standard Method to Mixed Costs:

Recoverable VAT on mixed costs = 7,200 × 70% = 5,040

Step 4 — Calculate Total Recoverable VAT:

Total Recoverable VAT = 9,600 + 5,040 = 14,640

Unrecoverable VAT = 5,360

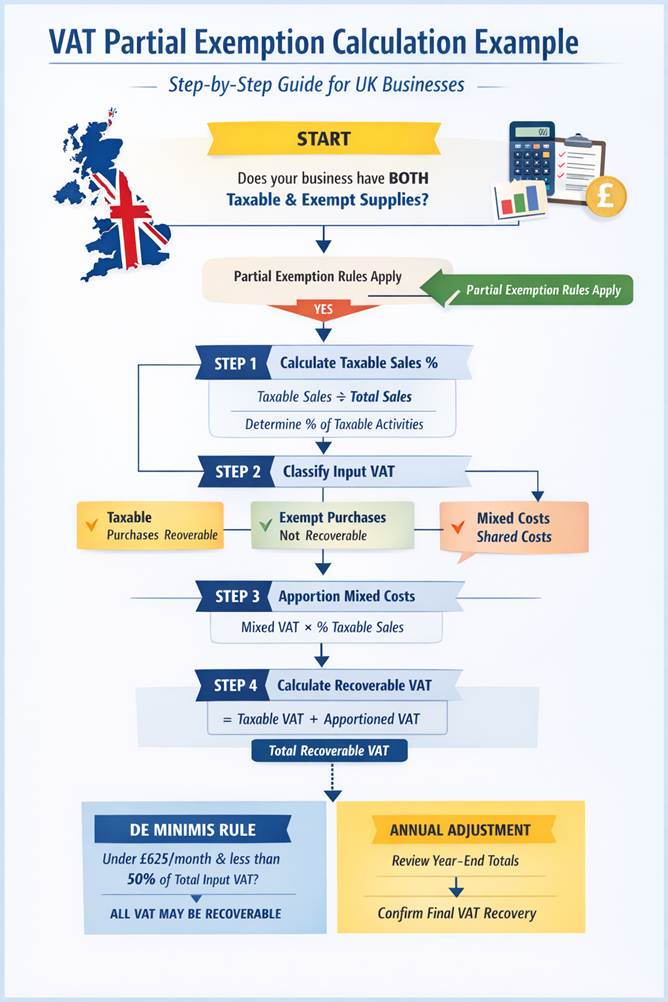

Flowchart: Step-by-Step Process

The following flowchart illustrates the Vat partial exemption calculation example step by step, making it easy to apply to your own business.

Special Rules & Considerations

- De Minimis Rule: If unrecoverable VAT is under £625 per month and less than 50% of total input VAT, all VAT may be recoverable.

- Annual Adjustment: Align provisional calculations with the actual figures at year-end.

- Special Method: Can be approved by HMRC if the standard method does not accurately reflect the actual use of costs.

Annual Adjustment: Practical Example

At the end of the VAT year, partially exempt businesses must perform an annual adjustment to make sure the VAT recovered reflects the actual figures rather than just provisional estimates.

Example

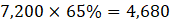

Assume the business initially estimated that 65% of sales would be taxable. On mixed costs, the provisional VAT recovery would be:

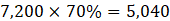

At year-end, actual taxable sales were 70%, so the correct recovery is:

Seeking direction or exploring opportunities?

Contact us by using the form below.

Annual Adjustment

Adjustment=5,040−4,680=360

The business can reclaim the additional £360 in its final VAT return. If it had over-claimed, the excess would need to be repaid to HMRC.

Why It Matters

The annual adjustment ensures VAT recovery reflects the true economic activity over the year, not temporary fluctuations in individual VAT periods. This is especially important for businesses with seasonal income or varying proportions of taxable and exempt supplies.

Conclusion

This VAT partial exemption calculation examples hows how partial exemption works in practice, translating HMRC guidance into a clear, repeatable calculation. Together with the WellTax guide, it gives both the technical foundation and practical insight needed to calculate recoverable VAT accurately, remain compliant, and know when exceptions such as the de minimis rule or a special method may apply.