Why Small Business Relief Matters

Small Business Relief (SBR) is one of the most useful provisions under the UAE Corporate Tax framework. It’s specifically designed to support smaller companies with revenues under AED 3 million. By offering tax savings and simpler compliance, it allows business owners to focus on growth and operations, rather than getting bogged down in paperwork.

We’ve previously shared an overview in our article “Small Business Relief in the UAE”, where we explained the basic rules and eligibility requirements. In this follow-up, we’ll explore the practical side – the real benefits, potential drawbacks, and how small businesses can plan ahead to make the most of this relief while it’s still available.

At WellTax, we help small businesses assess their eligibility, guide them through the SBR election process, and ensure compliance while maximizing available tax advantages. Think of this as a hands-on guide to how Small Business Relief can impact your finances, operations, and long-term planning.

Benefits of Small Business Relief UAE

No corporate tax liability & Growth opportunities

The most immediate benefit of Small Business Relief is financial. Eligible businesses don’t have to pay corporate tax for the relevant period, meaning profits stay in the business. This gives owners cash to:

- Cover day-to-day operating expenses

- Hire new employees and strengthen the team

- Invest in technology, equipment, or infrastructure

- Reinvest in marketing, research, or business expansion

Beyond the tax savings, SBR creates opportunities for growth. With immediate tax pressure lifted, businesses can:

- Explore new markets or customer segments

- Formalize previously informal operations, building credibility with clients and partners

- Take calculated risks that would otherwise be too expensive

Even modest savings can make a significant difference, especially for startups or small businesses during slow months or uncertain economic periods.

Example: A local retail business using SBR could reallocate funds that would have gone to taxes into opening a new branch or launching an e-commerce platform.

Pro tip: Think of SBR as a temporary boost to your working capital. It’s a chance to invest strategically, improve stability, and plan for long-term growth.

Simplified Compliance

Another major advantage is the simplification of tax compliance. For many small business owners, preparing accounts and calculating taxable income can be time-consuming and stressful.

With SBR:

- Traditional, detailed accounting methods are not required

- Financial statements can be prepared using simpler approaches, such as cash basis accounting

- Filing a tax return with the FTA becomes straightforward, with less risk of errors

The relief reduces paperwork and allows owners to spend more time running the business.

Example: Instead of reconciling dozens of adjustments and preparing multiple supporting schedules, a small business owner can focus on tracking cash inflows and outflows, then submit a simplified return with confidence.

At WellTax, we assist businesses with record organization, accurate filing, and ensuring FTA compliance, all while keeping the process stress-free and efficient.

Temporary Exemptions from Certain Tax Rules

During the SBR election period, eligible businesses are temporarily exempt from several corporate tax rules, which reduces stress and administrative work. Examples include:

- Interest deduction limitations: Businesses with significant debt normally face restrictions on deductible interest. Under SBR, these limits are temporarily lifted, simplifying calculations.

- Expense deduction restrictions: Some expenses normally require detailed tracking or are only partially deductible. SBR temporarily suspends these rules.

- Transfer pricing documentation: Normally, related-party transactions require detailed documentation to ensure compliance with arm’s length pricing. SBR waives these requirements, saving time and effort.

Although, businesses still need to ensure transactions are conducted at arm’s length, as the FTA can review corporate tax affairs if needed.

These exemptions give owners more time, flexibility, and peace of mind. They can focus on running daily operations, improving products, or exploring growth opportunities without worrying about complex technical rules.

Now that we’ve uncovered how Small Business Relief UAE can ease your tax load and support business growth, it’s time to flip the coin. Like any incentive, SBR comes with a few conditions and limitations worth understanding. Let’s take a closer look at the potential challenges so you can make informed decisions for your business.

Drawbacks and Limitations of the Small Business Relief UAE

Temporary Validity

Small Business Relief applies to Tax Periods starting on or after 1 June 2023. It can continue to be used up to Tax Periods ending on or before 31 December 2026, as long as the business’s Revenue does not exceed AED 3,000,000 in that period and in all earlier periods.

This means businesses can enjoy the relief and its benefits only for tax periods ending on or before that date. It’s important for business owners to plan ahead so they can switch smoothly to the regular corporate tax rules when the relief ends. That might include reviewing budgets, checking cash flow, and preparing for normal tax filings.

The FTA could extend the relief in the future, but for now, companies should focus on making the most of SBR before the end of 2026. Planning ahead ensures that your business doesn’t face any surprises and can continue to operate smoothly once the relief period is over.

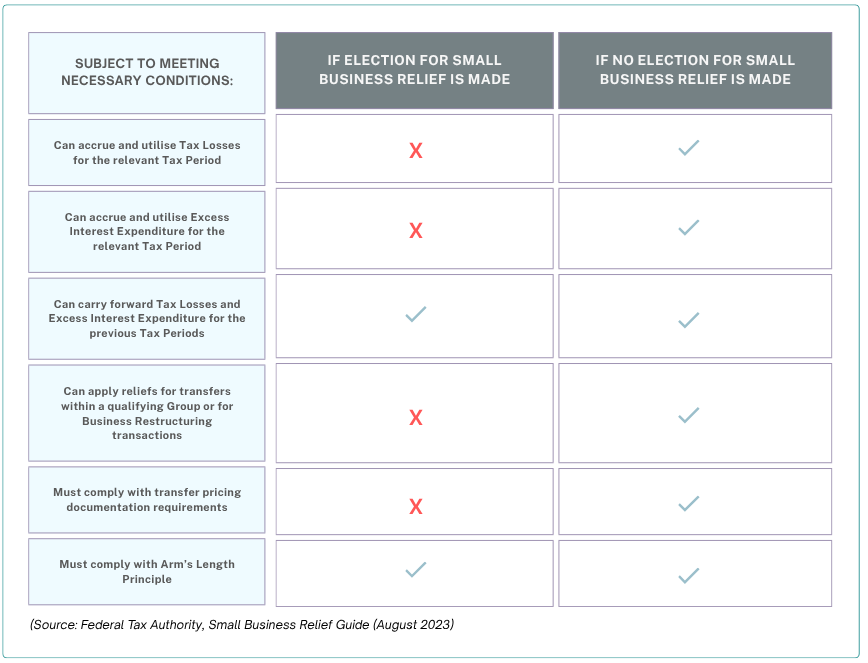

Impact on Tax Losses and Future Deductions

Businesses that elect Small Business Relief cannot accrue, use, or transfer tax losses for the period of election. Similarly, deductions for interest or other expenses cannot be carried forward to future periods.

While this simplifies reporting for the year, it can have implications for longer-term tax planning especially for businesses with significant past losses or those expecting higher profits in the coming years.

Example: Imagine your company has accumulated significant tax losses from previous years. Normally, these losses could be carried forward to offset future profits and reduce your corporate tax. If you choose to apply Small Business Relief in a given tax period, you will not pay tax for that period. However, any past losses cannot be used in the period where SBR is applied. Those previous losses can still be carried forward and used in future years once you are no longer applying Small Business Relief.

At the same time, any tax losses that arise during a year in which Small Business Relief is applied cannot be carried forward to future periods.

- Immediate benefit: You save on tax this year, which can help with cash flow, and reporting for the year is simpler.

- Future drawback: If your business expects higher profits in the coming years, you will not be able to use past losses to reduce your tax bill, which could result in a higher tax liability later.

In practice, this means that while SBR provides short-term relief, it may not always be the best choice for companies with significant tax losses or those expecting strong taxable income in the coming years. Careful planning and professional advice are essential to ensure the decision aligns with your business’s long-term tax strategy.

Seeking direction or exploring opportunities?

Contact us by using the form below.

Record-Keeping Responsibilities

Even with simplified returns under Small Business Relief, maintaining accurate and organized records is essential to prove your eligibility. The FTA may request supporting documentation at any time, so having everything in order helps avoid penalties and ensures smooth interactions.

Typical documents businesses should keep include:

- Bank statements

- Sales ledgers

- Invoices and receipts

- Delivery notes and order records

- Other relevant business correspondence

Proper record-keeping doesn’t just satisfy the FTA, it also helps business owners track performance, plan cash flow, and make informed decisions. At WellTax, we guide clients on how to organize records efficiently, ensuring compliance is straightforward and stress-free.

For a more detailed overview of the types of documents every business should maintain for corporate tax purposes, you can refer to our previous blog post: Essential Record-Keeping Documents for UAE Corporate Tax Compliance. Following these best practices makes both filing and potential audits much simpler, giving business owners peace of mind while maximizing the benefits of Small Business Relief UAE.

Tax Group Limitation

Small Business Relief UAE allows companies under common ownership to form a tax group. However, there’s an important limitation: all companies in the group share a single AED 3 million revenue threshold. This means it’s easier for the combined revenues to exceed the limit, potentially making the group ineligible for SBR even if each individual company is below AED 3 million.

It’s also important to note that artificially splitting a business into multiple entities just to stay under the threshold is not allowed. The FTA has clear powers to prevent this under the General Anti-Abuse Rule (GAAR). If a business is found to have artificially separated its operations to gain SBR eligibility, and its overall revenue exceeds AED 3 million, it will lose the relief. In that case, the business may have to repay any corporate tax it would have owed if it hadn’t separated, and penalties could also apply.

For business owners, this means planning must be genuine and commercially justified. At WellTax, we help clients understand how the tax group rules apply and ensure that any structuring decisions are both legitimate and strategically sound, avoiding any unintended consequences.

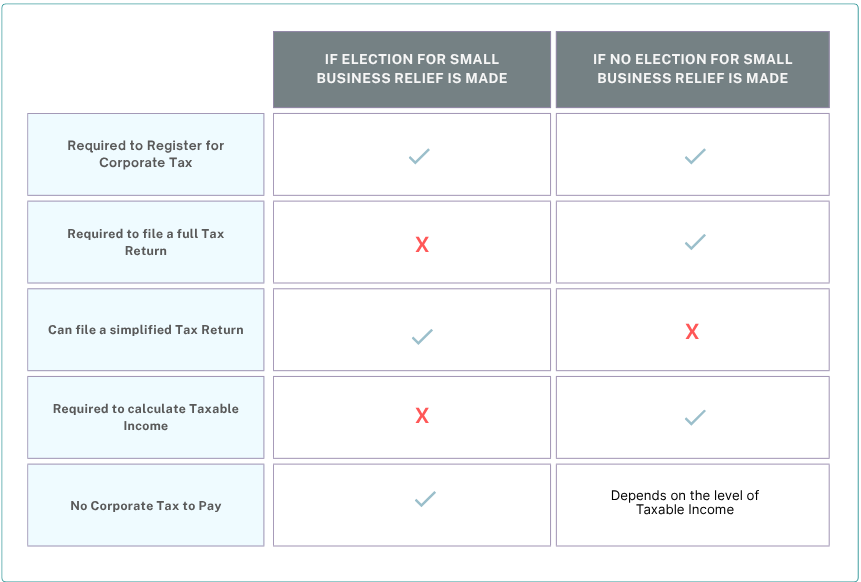

Summary Table: Impact of the Small Business Relief UAE

To make the practical implications clearer, the FTA provides a concise overview of how electing for Small Business Relief differs from following the standard corporate tax rules. This summary highlights what changes for your business in terms of tax liability, compliance requirements, eligibility for deductions, and record-keeping.

This snapshot makes it easier for business owners to see at a glance the areas where SBR provides relief and where extra caution or planning is needed.

Practical Tips for Businesses Considering Small Business Relief UAE

After exploring the benefits and potential drawbacks of Small Business Relief, it’s clear that careful planning is key. Before making any election:

- Know your numbers: Ensure your revenue is within the AED 3 million threshold and consider future projections, especially if you have significant tax losses or expect growth.

- Keep organized records: Maintain clear documentation of your revenue and transactions to support eligibility and simplify compliance.

- Plan for the future: Think ahead to the end of the SBR period in 2026. Consider how standard corporate tax rules will affect your business once the relief expires.

Wrapping Up

Small Business Relief isn’t just a tax break. It’s an opportunity to strengthen your business foundation, improve cash flow, and focus on growth. But like any tool, it works best when used thoughtfully. By understanding your eligibility, keeping accurate records, and planning for the end of the relief period, you can make strategic decisions that benefit your business now and in the future.

At WellTax, we’ve seen firsthand how careful planning and informed decisions can turn Small Business Relief UAE into a real advantage for small businesses. Taking the time to understand the rules and prepare ahead means you’re not just saving on taxes. You’re setting your company up for smoother operations, smarter investments, and long-term success.